Course Description:

Finance Fundamentals is a comprehensive course designed to provide participants with a solid understanding of essential financial concepts and analytical techniques. Through a combination of theory and practical exercises, participants will learn how to analyse financial statements, interpret key financial ratios, and evaluate the financial health and performance of companies. The course also covers topics such as cash flow analysis, capital structure, and comparative financial analysis, equipping participants with the knowledge and skills needed to make informed financial decisions.

Prerequisites:

- Trainees should be proficient in web surfing, Microsoft Excel.

- Able to communicate in English.

- For in-person training, do bring along a laptop that has Microsoft Excel.

Course Target Audience:

This course is tailored for working professionals in Singapore who seeks to improve their financial literacy. It is suitable for:

- Entry to mid-level professionals in non-finance-related roles.

- Entrepreneurs.

- Individuals seeking to transition into finance careers.

Course Highlights:

- Gain insight into income statement analysis and learn how to evaluate revenue quality.

- Understand the components of the balance sheet and differentiate between types of assets and liabilities.

- Learn how to analyse cash flow statements and interpret the significance of cash inflows and outflows.

- Calculate and interpret financial ratios to assess a company’s performance, financial health, and operational efficiency.

- Explore different methods of comparative financial analysis and learn how to select the right benchmarks.

- Get hands-on experience with online financial analysis tools to access and analyse financial data effectively.

- Engage in real-world applications through case studies to reinforce learning and apply financial analysis techniques in practical scenarios.

Course Objectives:

Upon completion of the course, participants will be able to:

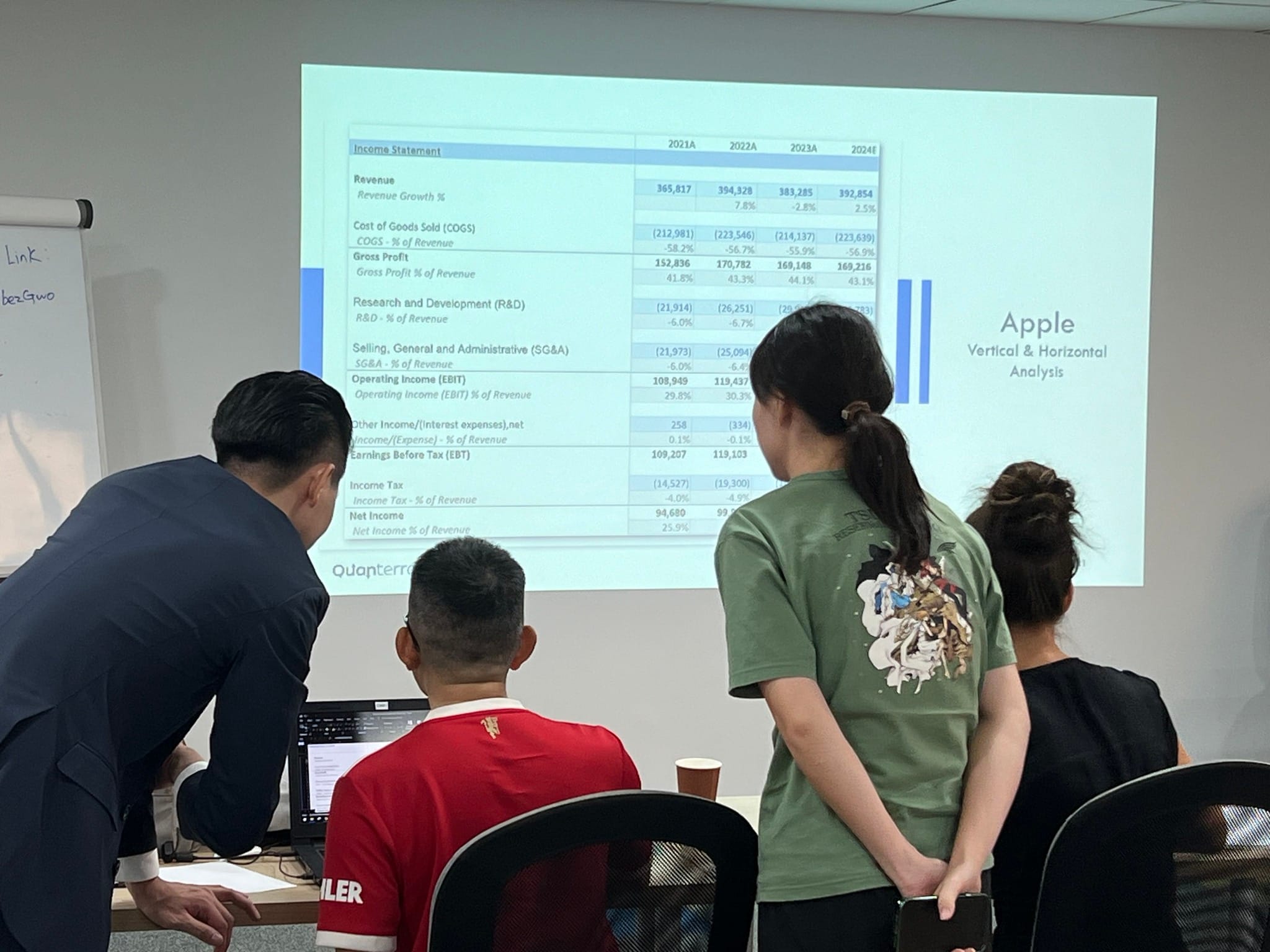

- Understand the main components of the income statement and perform horizontal and vertical analysis to evaluate trends and relationships within financial data.

- Identify the main components of the balance sheet and differentiate between types of assets and liabilities.

- Analyse cash flow statements to gain insights into cash inflows and outflows and understand the importance of depreciation and amortization.

- Calculate and interpret various financial ratios to assess a company’s performance, financial health, and operational efficiency.

- Examine different methods of comparative financial analysis and learn how to select appropriate benchmarks.

- Develop proficiency in using online financial analysis tools to access and analyse financial data efficiently and accurately.

Course Outline:

Income Statement Analysis

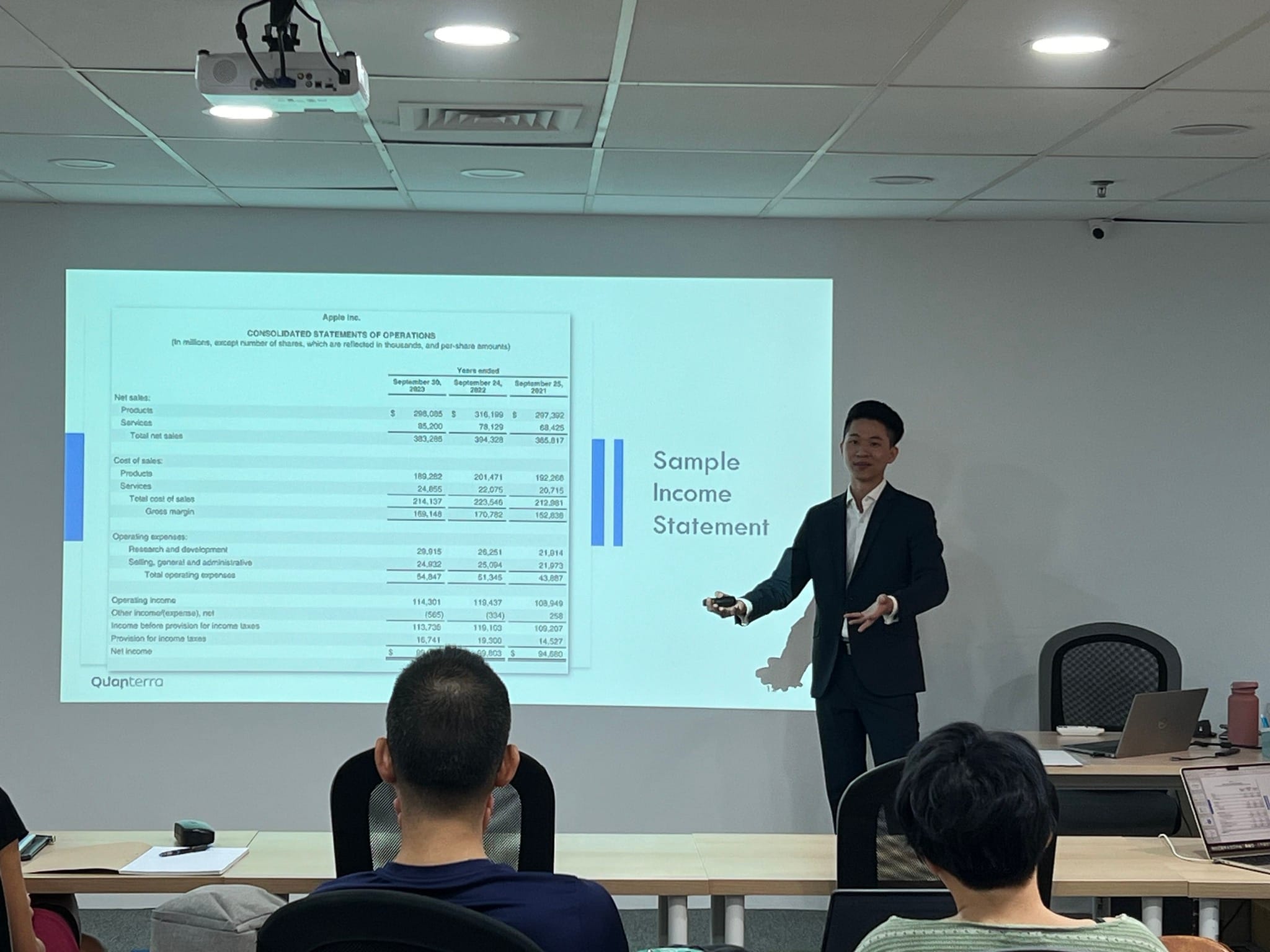

- Understand the main components Income Statement.

- Determine quality of revenue earnings.

- Perform horizontal and vertical analysis to evaluate trends and relationships within financial data.

- Apply comparative analysis to access competitiveness with other companies within the industry.

Balance Sheet Analysis

- Understand the main components Balanced Sheet.

- Differentiate types of assets and liabilities.

Cash Flow Statement

- Understand the main components Cash Flow Statement.

- Analyse insights into the cash inflows and outflows of a company during a specific period.

- Evaluate the importance of depreciation and amortization.

- Compute depreciation and amortization using straight line or double declining balance method.

- Understand how current assets and liabilities affect operating cash flow.

- Discuss the implications of positive and negative cash flows.

- Explore the difference between cash flow and accounting profit.

Financial Ratios Analysis

- Highlight the significance of ratio analysis in assessing a company’s performance, financial health, and operational efficiency.

- Calculate and interpret the various ratios derived from a company’s financial statements. (Leverage, Efficiency, Profitability, Liquidity, Investor Ratios)

- Examine capital structure of a company.

- Compare debt financing vs equity financing.

- Interpret and calculate cash conversion cycle.

- In-depth analysis into return on equity (ROE) using Dupont Analysis.

- In-depth analysis into company’s valuation.

Comparative Financial Analysis

- Examine the different types of benchmarks.

- Determine effective methods on selecting the right benchmarks.

Guide on utilizing online financial analysis tools, focusing on navigating specific websites to access financial data.

Instructors

Calvin Wu

This event has ended.

Get Exclusive Invitations to Quanterra’s Events

From free workshops, webinars, to networking sessions, never miss an invitation to learn and grow your network.

Event Gallery

Testimonials

See what people say about us after completing our courses